child tax credit november payment

The deadline for the next payment was November 1. CBS Baltimore -- The fifth.

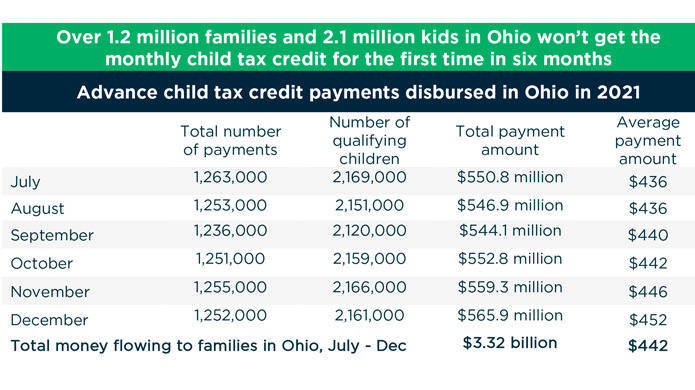

Nevada Families Have Netted 750 Million From Child Tax Credit So Far This Year Nevada Current

The three credits include.

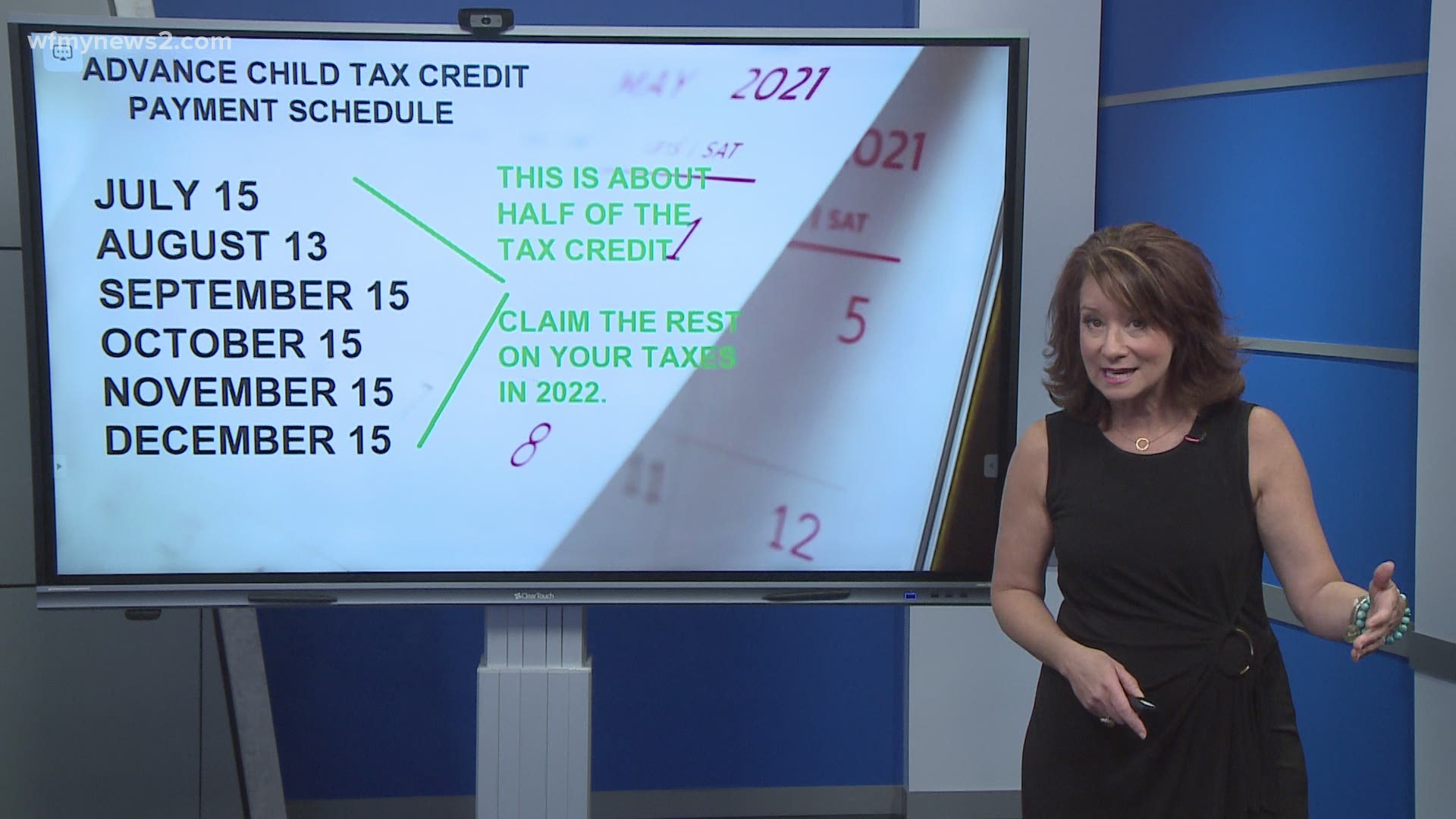

. MILLIONS of Americans have the chance to cash in on two more stimulus checks in the form of the child tax credit that are set to hit bank accounts this year. The payment for the. The advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15 was the latest payment day.

The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021. Could be next-to-last unless Congress acts. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families will.

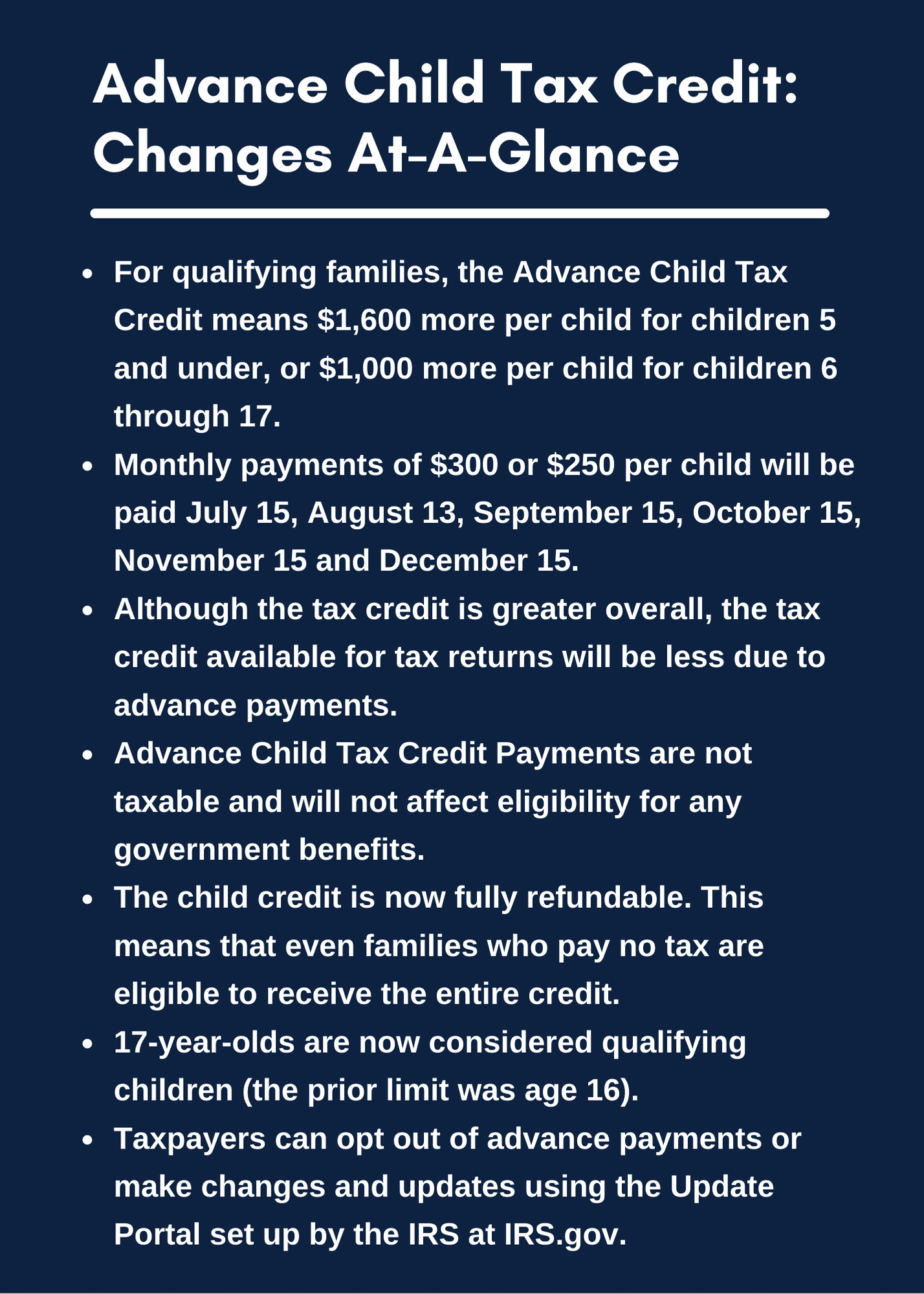

Payments will be issued automatically starting November 4 2022. Advance Child Tax Credit Payments in 2021. The enhanced Child Tax Credit increased this benefit as high as 3600 a child in 2021 up from its normal amount of 2000 per child.

S tarting last Monday November 15 a new advance Child Tax Credit CTC payment is being disbursed by the IRS this is the fifth of six monthly payments that are sent. Families can claim this credit even if they received monthly advance payments during the last half of 2021. Future payments are scheduled for November 15 and.

The last opt-out deadline for the last future payment of the current version of the advance Child Tax Credit is November 29. To reconcile advance payments on. Meanwhile parents with children between the ages of six and 17 will receive up to 1500 in six monthly payments of.

IR-2021-222 November 12 2021. Child Tax Credit Dates Here S The Entire 2021 Schedule Money 2 days agoAccording to a recent. Under the American Rescue Plan Act of 2021 we sent advance Child Tax Credit payments of up to half the 2021 Child Tax Credit to.

An expanded Child Tax Credit. Under the American Rescue Plan most eligible families received payments dated July 15 August 13 and September 15. The percentage depends on your income.

WASHINGTON On Monday November 1 the Internal Revenue Service will launch a new feature allowing any family receiving monthly Child. November 29 The Child Tax Credit Update Portal allows. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

The expanded Child Tax Credit boosted the benefit to 3600 for each child under 6 and 3000 for kids ages 6 to 17 with half of those amounts provided in monthly checks. The enhanced child tax credit which was created as part. It could be extended through 2022 under Democrats 175 trillion social.

The October child tax credit payment will arrive this week. Six payments of the Child Tax Credit were and. Under the Biden administrations 2021 American Rescue Plan the child tax credit was expanded from 2000 per child to 3000 per child for children over the age of six and.

IR-2021-211 October 29 2021. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Your payment will be mailed to you or deposited into your bank account if youre signed-up for direct deposit.

IR-2021-153 July 15 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving. Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year. The deadline for the next payment was November 1.

The last opt-out deadline for the last future payment of the current version of the advance Child Tax Credit is November 29. Your child tax credit payments will phase out by 50 for every 1000 of income over those threshold amounts according to Joanna Powell managing director and certified. Child tax credit payments set to go out Monday.

The tax credit is aimed at helping parents.

E C Financial Services And Tax Preparation Child Tax Credit Expansion When Will The First Checks Get Sent Out We Know The Child Tax Credit Payments Will Begin Arriving In July But

Final Child Tax Credit Payment Opt Out Deadline Is November 29 Kiplinger

Advance Child Tax Credit Payments Coming To A Bank Account Or Mailbox Near You Accountant In Orem Salt Lake City Ut Squire Company Pc

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

Child Tax Credit Faqs For Your 2021 Tax Return Kiplinger

Three More Advanced Child Tax Credit Payments To Hit Accounts Wfmynews2 Com

What S At Stake For Families As The Monthly Child Tax Credit Payment Ends Ohio Capital Journal

How Monthly Child Tax Credit Checks May Be Renewed By Congress

Irs Makes First Payments Of Advanced Child Tax Credit On July 15 Wfmynews2 Com

Child Tax Credit Payments Glitch Causes Smaller October November December Money How To Know If You Re Affected Itech Post

Families To Get 300 Child Tax Credit Boost In Time For Thanksgiving See If You Re Eligible The Us Sun

Advance Child Tax Credit Financial Education

Child Tax Credit Why November Payment May Be Less This Month King5 Com

Advance Child Tax Credit Update November 1 2021 Youtube

Stimulus Checks You May Have To Pay Back November Child Tax Credit

When Will You Get The Child Tax Credit Payment In November 2021

When Is My November Child Tax Credit Irs Check Arriving 13newsnow Com